In an era defined by shifting energy priorities and global market dynamics, understanding the long-term impacts of liquefied natural gas (LNG) exports is more important than ever. The U.S. Department of Energy’s (DOE) LNG Export Study & Response to Comments (officially “Energy, Economic, and Environmental Assessment of U.S. LNG Exports”[1]) provides critical insights into how expanded LNG exports influence the domestic energy market, economic output, and environmental outcomes. Due to the complexity of the topic, the analysis required a robust modeling framework that leveraged two existing groups from KeyLogic’s Systems Research & Analysis team. One group was OnLocation, KeyLogic’s premier energy and economic modeling division. As recognized experts in the use of the National Energy Modeling System (NEMS), we were uniquely positioned to assess the energy and economic implications of LNG exports with accuracy and depth. The second group was KeyLogic’s Life Cycle Analysis (LCA) team which developed the framework for a whole supply chain analysis quantifying the consequences from increasing levels of U.S. LNG exports in terms of changes to domestic and global emissions.

The DOE LNG Study Update: Key Takeaways

DOE’s study evaluates the impacts of LNG exports at higher volume levels than previously studied—up to 48 billion cubic feet per day (Bcf/d)—in light of global demand scenarios and U.S. market trends. Key conclusions include:

• Macroeconomic Gains: Higher LNG exports continue to contribute positively to U.S. GDP, driven by increased natural gas production and investment.

• Domestic Prices Rise Modestly: While higher exports lead to upward pressure on natural gas prices, the increases are moderate due to the robust resource base and production scalability.

• Energy Security: Increased U.S. LNG exports can strengthen domestic and international global security with no discernable impact to global greenhouse gas emissions.

These findings are not static forecasts, but they depend on a complex web of assumptions, market behaviors, and policy trajectories. Systems Research and Analysis capabilities account for the interplay between these forces and factors to deliver deep insights that create a powerful vision of potential scenarios as the LNG export market continues to grow.

Modeling Methods: OnLocation and the Power Behind NEMS

KeyLogic has the ability to customize the National Energy Modeling System (NEMS) for key studies that complement DOE’s long-term energy forecasting. NEMS is a detailed, integrated energy-economic model that simulates the entire U.S. energy market, incorporating:

• Energy production and consumption

• Macroeconomic feedback

• Technology adoption

• Environmental regulations

• International trade

For the LNG study, we enhanced NEMS to account for a broader range of export volumes and global market conditions.

Modeling Complexity: Balancing Global Trade and Domestic Stability

Modeling LNG exports is uniquely challenging. It involves projecting both U.S. supply capacity and uncertain global demand—factors influenced by geopolitics and innovation. OnLocation’s enhanced version of NEMS integrates:

• Global gas market linkages through export demand curves

• Price-sensitive production forecasts that react to both domestic and international signals

• Policy modules that simulate regulatory environments

These additional features allow DOE analysts and policymakers to explore “what if” scenarios that explore a range of market, technology, and policy factors and assess their ripple effects on U.S. consumers and producers.

Life Cycle Perspective: Holistic Policy Analysis

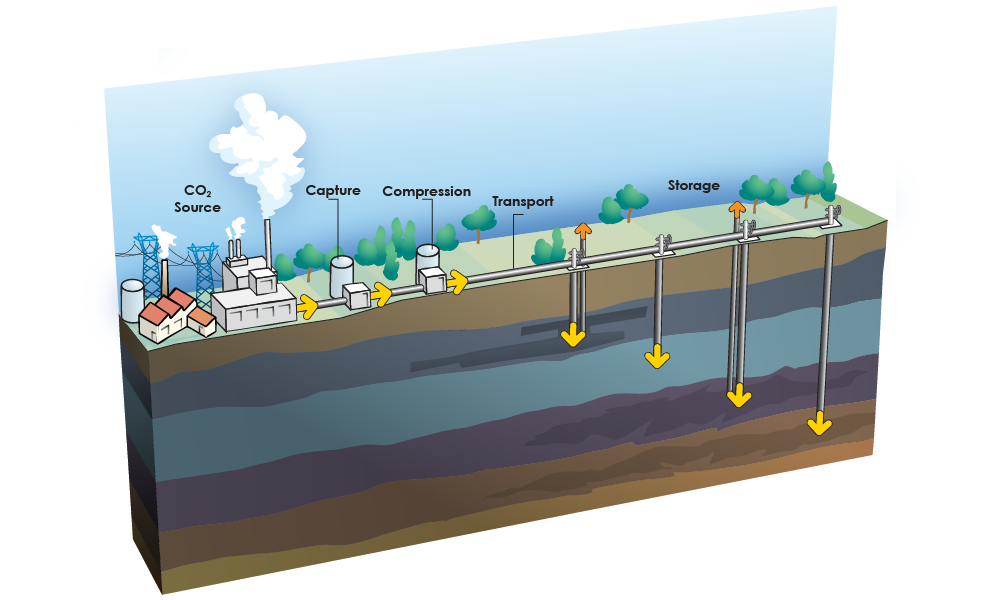

As the LNG export conversation increasingly overlaps with national goals, understanding the life cycle emissions of upstream natural gas and LNG infrastructure becomes essential. The LNG study includes a consequential life cycle analysis led by KeyLogic’s Systems Research & Analysis team, revealing the complex interplay between upstream domestic and foreign methane leakage, liquefaction efficiency, and the ultimate displacement effect of LNG in global markets.

Using frameworks consistent with ISO standards and integrating tools such as GREET, OpenLCA, and custom-built emissions inventories, we help clients evaluate complicated energy pathways. KeyLogic’s expertise in Life Cycle Assessment (LCA) could extend this analysis by evaluating:

- Emissions impacts across the entire LNG value chain, from wellhead to end-use, for any interested party in the natural gas industry.

- How regional variations (e.g., Permian vs. Marcellus) affect emissions profiles.

- How reported emissions by facilities in the LNG value chain (e.g., wells or processing locations) compare to emerging top-down data that identify geo-located methane plumes.

- The comparison of LNG vs. alternative fuels in different importing countries.

- The role of methane monitoring and abatement in improving the relative carbon performance and efficiency of U.S. gas exports as markets like Europe require these activities.

Outcome: Informing Policy with Rigor and Transparency

By marrying DOE’s policy mandate with KeyLogic’s technical expertise and our unique modeling capabilities, the LNG Study Update offers not just results, but a transparent, reproducible framework for decision-making. This is especially crucial as the U.S. government considers future LNG export approvals that advance economic and national security interests.

As global energy systems evolve, the need for robust, scenario-based analysis becomes even more urgent. KeyLogic’s contributions ensure that U.S. energy policy is grounded in data and driven by systems thinking that capture the complexity of the global energy ecosystem.

[1] www.energy.gov/articles/doe-finalizes-2024-lng-export-study-paving-way-stronger-american-energy-exports